A Beginner’s Guide to Bitcoin

Bitcoin, often referred to as digital gold or digital property, has gained significant popularity and acceptance since its creation in 2009. As a decentralized currency, it operates outside traditional banking systems, offering a new way to store and transfer value. This article will help you understand the basics of Bitcoin, its benefits, and how to get started with investing in it.

What is Bitcoin?

Bitcoin is a digital currency created by an unknown person or group of people using the pseudonym Satoshi Nakamoto. This is key because it has no owner, no CEO, no address and no manager that can change the underlying properties of Bitcoin. Unlike traditional currencies, it is not issued or controlled by any government or central bank either. Instead, Bitcoin transactions are verified by network nodes through cryptography and recorded on a public ledger called the blockchain.

The blockchain is a decentralized system where transactions are grouped into blocks and linked together in a chain. This ensures transparency, security, and immutability, making it nearly impossible to alter or forge transactions. Key when governements do this on a daily basis.

Why Invest in Bitcoin?

There are several reasons why Bitcoin is considered a valuable investment:

1. Decentralization: Bitcoin is not controlled by any central authority, reducing the risk of government interference or manipulation.

2. Limited Supply: There will only ever be 21 million Bitcoins in existence, creating scarcity and potentially driving up its value over time.

3. Security: Bitcoin transactions are secured through cryptographic techniques, making them highly secure and resistant to fraud.

4. Transparency: All Bitcoin transactions are recorded on the blockchain, allowing anyone to verify and audit transactions.

5. Global Acceptance: Bitcoin can be used globally without the need for currency exchange, making it a universal medium of exchange.

Why Resilient not Reliant Invests in Bitcoin

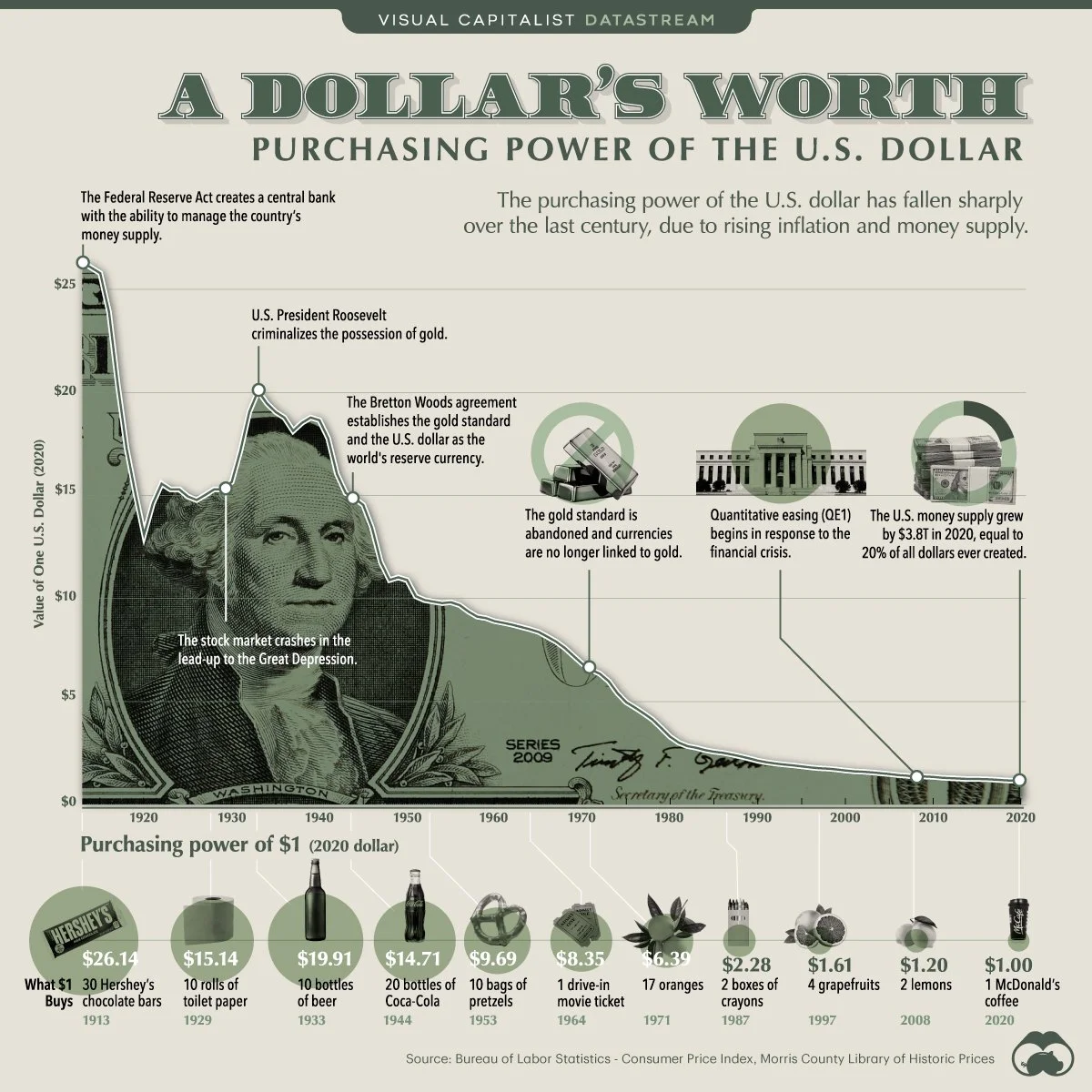

At RnR, we view Bitcoin as a cornerstone of financial resilience and independence. In a world where fiat currencies, which are any currency backed by nothing more than the trust of it’s government, are subject to inflation and devaluation, Bitcoin is a better alternative. At a minimum, Bitcoin is a reliable store of value - at best, it is the greatest performing asset of all time. Which isn’t a bad reason to invest either. Its decentralized nature also aligns with our philosophy of reducing dependency on centralized systems and authorities.

By investing in Bitcoin, we are not only protecting our wealth from the erosion of purchasing power caused by excessive money printing but also embracing a form of currency that empowers individuals. Bitcoin’s scarcity and deflationary properties make it a powerful hedge against economic instability, providing a safeguard for our financial future.

Furthermore, Bitcoin’s growing acceptance and integration into the global financial system enhance its utility, making it a versatile asset in our investment strategy. Through Bitcoin, we aim to achieve financial security and offset the financial fuckery taking place that devalues currency via money printing.

Oh yea - it’s is also up 20,000,000% since 2011… Yes, twenty million. Enough said ;)

Here is a visual on the decline of purchasing power of the US Dollar for comparison.

Getting Started with Bitcoin

Here’s a step-by-step guide to help you get started with investing in Bitcoin:

1. Educate Yourself: Before investing in Bitcoin, it’s essential to understand how it works, its potential risks, and benefits. Read articles, watch videos, and follow reputable sources to stay informed.

2. Choose a Wallet: A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. There are several types of wallets:

• Hardware Wallets: Physical devices that store your Bitcoin offline, providing the highest level of security.

• Software Wallets: Applications that you can install on your computer or mobile device.

• Web Wallets: Online services that store your Bitcoin for you. We don’t use these for anything more than buying Bitcoin. Always store your crypto on a hardware wallet like Ledger or Trezor.

3. Select an Exchange: To buy Bitcoin, you need to use a cryptocurrency exchange. These can be centralized (CEX) or decentralized (DEX). Some popular CEX’s include Coinbase, Binance, and Kraken. Popular DEX’s include Pancake swap, Sushiswap, and Matcha.

4. Buy Bitcoin: Once your account is set up, you can purchase Bitcoin. You can buy a fraction of a Bitcoin, making it accessible even if you don’t have a lot of money to invest.

5. Secure Your Investment: After purchasing Bitcoin, transfer it to your wallet for safekeeping. Avoid leaving your Bitcoin on the exchange, as exchanges can be vulnerable to hacks.

6. Stay Informed: The cryptocurrency market is highly volatile, so it’s crucial to stay updated on the latest news and trends. Follow reputable sources and consider joining online communities to learn from other investors.

Potential Risks and Considerations

While Bitcoin offers many benefits, it’s essential to be aware of the potential risks and challenges:

1. Volatility: Bitcoin’s price can be highly volatile, with significant price swings occurring over short periods. Be prepared for fluctuations in value and invest only what you can afford to lose.

2. Regulatory Risks: Governments around the world are still figuring out how to regulate Bitcoin and other cryptocurrencies. Changes in regulations could impact its value and usability.

3. Security Risks: While Bitcoin transactions are secure, the wallets and exchanges that store Bitcoin can be vulnerable to hacking. Always use reputable services and take steps to secure your investments.

4. Market Sentiment: Bitcoin’s value can be influenced by market sentiment, news, and events. Stay informed and be cautious of hype and speculation.

Bitcoin represents a revolutionary shift in how we think about money and finance. Its decentralized nature, limited supply, and growing acceptance make it an attractive investment for those looking to diversify their portfolios and hedge against traditional financial systems.

By educating yourself, choosing the right tools, and staying informed, you can successfully navigate the world of Bitcoin and potentially reap the benefits of this innovative digital currency. At RnR, we believe in empowering individuals with the knowledge and resources needed to build resilient finances. Start your journey with Bitcoin today and take control of your financial future.