Bitcoin: A Thermodynamic, Psychological, and Sovereign Power Projection.

In the midst of global power struggles, where nations flex military might and central banks wield economic control, Bitcoin emerges as an unconventional titan—a decentralized force projecting power through resilience rather than reliance. This essay dives into Bitcoin’s thermodynamic elegance, transforming energy into an unshakable trust network, and its psychological liberation, empowering individuals to break free from institutional chains. From its current role as a strategic escape hatch for sanctioned nations to future possibilities of sovereign, decentralized communities thriving on a global scale, Bitcoin embodies the “resilient, not reliant” ethos. With a nod to physics, a dash of humor, and a defiant middle finger to centralized tyranny, this exploration reveals Bitcoin as a cosmic revolution—one that could redefine power in our world and beyond. Dive into the full essay to uncover this transformative vision!

In the grand theater of world affairs, where nation-states flex their muscles through aircraft carriers, sanctions, and central bank printers, Bitcoin emerges as an unlikely yet potent protagonist—a decentralized, cryptographic trickster wielding power not through coercion but through resilience. To understand Bitcoin as power projection, we must strip away the noise of headlines and memes, diving into first principles, thermodynamics, psychology, and the ethos of sovereign, decentralized communities. This essay explores Bitcoin’s role in reshaping global power dynamics, its future possibilities, and how it embodies the “resilient, not reliant” framework. Buckle up—this ride is equal parts physics lecture, anarchist manifesto, and cosmic comedy.

Bitcoin as Thermodynamic Power Projection.

Let’s start with physics, because the universe doesn’t care about your geopolitical posturing—it runs on energy. Power projection, traditionally, is about expending energy to enforce will: tanks roll, missiles fly, and central banks burn electricity to maintain fiat dominance. Bitcoin, however, projects power through thermodynamic elegance. Its proof-of-work (PoW) consensus mechanism is a masterclass in converting energy into trust. Miners compete to solve cryptographic puzzles, expending computational energy to secure the network. This isn’t wasteful—it’s a deliberate trade-off, a thermodynamic handshake ensuring no single entity can rewrite the ledger without overwhelming the system’s energy expenditure.

Think of Bitcoin as a black hole of trust: it absorbs energy (hashpower) and emits certainty (immutable transactions). Unlike fiat systems, where trust is outsourced to fallible institutions, Bitcoin’s power stems from its ability to align incentives with the second law of thermodynamics—entropy must increase, but Bitcoin channels this chaos into order. It’s a global, permissionless system that doesn’t care if you’re a nation-state or a nomad with a laptop. This is power projection without borders, a middle finger to centralized control, achieved by harnessing the universe’s rawest currency: energy.

In today’s world, where economic sanctions weaponize SWIFT and dollar hegemony, Bitcoin projects power by offering an escape hatch. Countries like Iran or Venezuela, squeezed by financial isolation, can transact in Bitcoin, sidestepping the gatekeepers. This isn’t just economic—it’s strategic. A nation holding Bitcoin reserves projects resilience, signaling it can’t be fully choked by external pressures. It’s the geopolitical equivalent of a judo move: using the opponent’s force (globalization’s interconnectedness) against them.

The Psychology of Bitcoin: Trust Without Tyranny.

Power isn’t just tanks and trade routes; it’s psychological. Humans crave certainty in an uncertain world, and traditional power structures exploit this by centralizing trust. Governments and banks say, “Trust us, we’ve got this,” while quietly inflating your savings or freezing your accounts. Bitcoin flips the script, projecting power through psychological liberation. It’s a system where trust emerges not from a charismatic leader or a marble-clad institution but from code and consensus.

This is where Bitcoin’s resilience shines. Psychologically, it empowers individuals by removing reliance on intermediaries. You don’t need a bank’s permission to send value across borders; you don’t need a government’s blessing to hold wealth that can’t be confiscated without your private key. This fosters a mindset shift: from dependence to sovereignty. In a world of surveillance states and cancel culture, Bitcoin’s pseudonymity is a psychological shield, letting you operate without fear of retribution. It’s the digital equivalent of a secret handshake in a dystopian novel—quiet, defiant, and deeply empowering.

Humorously, Bitcoin’s community embodies this ethos with a mix of nerdy bravado and meme-lord swagger. HODLers (a typo-turned-mantra) laugh in the face of volatility, projecting confidence that borders on absurd. When prices crash, they post GIFs of cartoon bulls charging back. This isn’t just bravado—it’s psychological warfare against fiat’s fear-based control. Bitcoiners don’t just hold coins; they hold a worldview that says, “We’re building something antifragile, and your sanctions can’t touch it.”

Future Possibilities: Bitcoin as a Sovereign Network.

Looking ahead, Bitcoin’s potential as a tool for power projection grows exponentially. Imagine a world where decentralized communities—think city-states, DAOs, or even nomadic tribes—use Bitcoin as their economic backbone. These groups, unbound by geography, project power not through military might but through economic independence. A community running on Bitcoin can trade globally, store wealth securely, and govern itself without relying on a central bank’s whims. This is the “resilient, not reliant” framework in action: systems that thrive under stress, not because they’re invincible, but because they’re adaptable.

Bitcoin’s future could see it powering microgrids of sovereignty. Picture a solar-powered commune in the Sahara, mining Bitcoin with excess energy, trading with a cooperative in Tokyo, all without a single SWIFT code. Or consider a nation-state adopting Bitcoin as a reserve asset, not just as a hedge against inflation but as a strategic deterrent. If your wealth can’t be seized or devalued by a foreign power, you’ve projected power without firing a shot.

This isn’t utopian fantasy—it’s grounded in Bitcoin’s design. Its fixed supply (21 million coins, forever) ensures scarcity, a thermodynamic anchor in a world of infinite money printing. Its decentralized nodes—tens of thousands worldwide—make it a hydra: cut off one head, and others grow back. Future iterations could integrate with layer-2 solutions like the Lightning Network, enabling instant, near-free transactions at scale. Imagine refugee camps settling trade in Bitcoin, bypassing corrupt intermediaries, or dissidents crowdfunding resistance via untraceable sats. This is power projection through resilience, not reliance.

Resilient, Not Reliant: The Bitcoin Ethos.

The “resilient, not reliant” framework is Bitcoin’s secret sauce. Traditional power structures rely on centralized chokepoints: a central bank, a single point of failure like SWIFT, or a government that can freeze assets. These systems are brittle—pull one lever, and they crumble. Bitcoin, by contrast, is resilient because it’s decentralized. No single entity controls the network; no single failure can bring it down. This mirrors nature’s most robust systems: think coral reefs or ant colonies, thriving through distributed redundancy.

Bitcoin’s resilience is also cultural. Its community—miners, developers, HODLers—operates like a decentralized immune system. When threats emerge (say, a proposed fork or regulatory crackdown), the network adapts, debates, and evolves. This isn’t blind optimism; it’s antifragility, as Nassim Taleb would say—Bitcoin grows stronger under stress. The 2017 scaling wars, where Bitcoin survived a contentious fork, proved this. So did China’s 2021 mining ban, which saw hashpower redistribute globally without missing a beat.

Humorously, Bitcoin’s resilience is like a cosmic prank on centralized power. Governments ban it, and miners move to Kazakhstan. Banks demonize it, and El Salvador adopts it as legal tender. The more you attack Bitcoin, the more it thrives, like a digital cockroach surviving a nuclear winter. This resilience empowers sovereign communities, from cypherpunks to small nations, to project power without reliance on fragile institutions.

The Cosmic Comedy of Bitcoin.

Let’s zoom out for a moment. In the grand sweep of cosmic history, Bitcoin is a hilarious rebellion against entropy’s tyranny. Civilizations rise and fall because they rely on centralized systems that decay—empires, banks, even gods. Bitcoin, born from a pseudonymous coder’s manifesto, is a thermodynamic middle finger to that cycle. It’s not just money; it’s a bet on human ingenuity, a wager that we can build systems that don’t just survive but thrive in chaos.

In today’s world, Bitcoin projects power by giving individuals and communities the tools to opt out of broken systems. In the future, it could underpin a global network of sovereign nodes, each resilient, none reliant. It’s not a utopia—it’s a toolbox. And like any good toolbox, it’s got a hammer for breaking things (fiat’s grip), a wrench for building things (decentralized economies), and a screwdriver for tweaking the system when it gets wonky.

So, here’s to Bitcoin: the thermodynamic trickster, the psychological liberator, the sovereign enabler. It’s not just a currency; it’s a power projection platform that laughs in the face of centralized control. In a world of tanks and tyrants, Bitcoin’s resilience whispers a radical truth: the future belongs to those who don’t need permission to thrive.

HODL: The Legend Born from a Typo (and Maybe a Little Whiskey).

Discover the origins of “HODL,” the infamous crypto term born from a drunken typo and a bit of market chaos. In 2013, BitcoinTalk user GameKyuubi accidentally typed “HODL” instead of “hold,” and the typo became a rallying cry for crypto enthusiasts everywhere. Now, it’s more than just a misspelled word; it’s a mindset of unwavering commitment to Bitcoin, even during the wildest price swings. Dive into the hilarious backstory and see why “HODL” has become a symbol of patience and belief in the future of decentralized finance.

If you’ve ever ventured into the wilds of crypto Twitter or any Bitcoin forum, you’ve seen it: HODL. It’s the rallying cry of Bitcoin maximalists, a badge of honor for those who diamond-hand their way through market crashes. But what you might not know is that “HODL” wasn’t born out of some grand strategy or fancy financial jargon. No, it was born from a drunk typo, and it’s exactly as glorious as it sounds.

In December 2013, a user named GameKyuubi made a post on the BitcoinTalk forum titled, “I AM HODLING.” And yes, the typo was unintentional. GameKyuubi was a bit tipsy (he admitted as much), frustrated with Bitcoin’s wild price swings and his own lack of trading prowess. So, instead of hitting the panic sell button like so many others, he chose to hold onto his Bitcoin. Or, as he famously put it, “HODL.”

Here’s the drunken manifesto that started it all:

“I type d that tyitle twice because I knew it was wrong the first time. Still wrong. w/e. GF's out at a lesbian bar, BTC crashing WHY AM I HOLDING? I'LL TELL YOU WHY. It's because I'm a bad trader and I KNOW I'M A BAD TRADER. Yeah you good traders can spot the highs and the lows pit pat piffy wing wong wang just like that and make a millino bucks sure no problem bro. Likewise the weak hands are like OH NO IT'S GOING DOWN I'M GONNA SELL he he he and then they're like OH GOD MY ASSHOLE when the SMART traders who KNOW WHAT THE FUCK THEY'RE DOING buy back in but you know what?

I'm not part of that group. When the traders buy back in I'm already part of the market capital so GUESS WHO YOU'RE CHEATING day traders NOT ME~! Those taunt threads saying "OHH YOU SHOULD HAVE SOLD" YEAH NO SHIT. NO SHIT I SHOULD HAVE SOLD. I SHOULD HAVE SOLD MOMENTS BEFORE EVERY SELL AND BOUGHT MOMENTS BEFORE EVERY BUY BUT YOU KNOW WHAT NOT EVERYBODY IS AS COOL AS YOU. You only sell in a bear market if you are a good day trader or an illusioned noob. The people inbetween hold. In a zero-sum game such as this, traders can only take your money if you sell.

so i've had some whiskey

actually on the bottle it's spelled whisky

w/e

sue me

(but only if it's payable in BTC)”

The post was a breath of fresh, honest air in the midst of market chaos. It was a cry of defiance against the volatility, a declaration of loyalty to Bitcoin. And the crypto community loved it. They rallied behind it, embraced the typo, and turned it into a symbol of resolve. “HODL” became the new mantra: Hold On for Dear Life.

What makes HODL so great is its simplicity and humor. It’s a reminder that even in a market driven by complex algorithms and high-stakes traders, sometimes the best strategy is the simplest one: just hold on and ride out the storm.

HODL: A Strategy and a Mindset

Since that infamous post, HODL has become more than a meme. It’s a philosophy. It’s about refusing to sell in the face of fear and uncertainty, believing that Bitcoin’s long-term value will outshine short-term losses. It’s the ultimate call to patience and faith in the future of decentralized finance.

And while the origin story may be a bit sloppy, isn’t that the perfect fit for crypto culture? In a world where billionaires lose fortunes overnight and new coins are minted out of thin air, a drunken typo evolving into a battle cry is just par for the course.

So next time the market takes a nosedive and you feel the urge to panic sell, remember the legend of GameKyuubi, whiskey in hand, steadfastly declaring, “I AM HODLING.” And maybe, just maybe, you’ll find the resolve to HODL too.

Inflation: The Government’s Stealth Tax and Your Best Defense.

Inflation isn’t just an economic term; it’s a hidden tax that silently erodes your purchasing power. As governments expand the monetary supply, they devalue your hard-earned currency, making everyday expenses more costly. In our latest article, we delve into how inflation impacts your finances and why traditional savings aren’t enough to safeguard your wealth. Explore effective hedges against this insidious tax, including Bitcoin, precious metals, and real estate. Discover how to protect your financial future in an ever-changing economic landscape.

Welcome to the world of modern finance, where money isn’t just paper; it’s a carefully constructed illusion supported by a debt-based monetary system. Let’s break it down: we live in a world where governments and central banks are masters of the money printer. They can conjure up currency at will, and guess what? That inflation we hear about isn’t just a nuisance; it’s a stealthy tax on your hard-earned cash.

When the government expands the monetary supply, they essentially dilute the value of every dollar in your pocket. Imagine if your favorite soda suddenly got watered down; you’d be left with less flavor and more fizz. That’s exactly what happens with your currency. As more money chases the same amount of goods and services, prices rise, and the purchasing power of your dollar decreases. This is inflation, and it’s a tax you didn’t sign up for.

Inflation is the silent killer of wealth, eroding savings and making it harder for you to get ahead. You might think your paycheck increases, but if it doesn’t keep pace with inflation, you’re running in place - or even falling behind. The government may pat itself on the back for the economic growth it claims, but in reality, it’s pocketing the difference between what you earn and what you can buy. It’s the ultimate sleight of hand, leaving many to wonder why they feel poorer despite rising wages.

So, how do you fight back against this relentless assault on your wealth? Enter Bitcoin and precious metals. These are the assets that stand tall against the tide of devaluation. Bitcoin, often referred to as digital gold, offers a decentralized alternative to fiat currency. It’s finite, meaning it can’t just be conjured out of thin air. As more people wake up to the reality of inflation, Bitcoin’s value has skyrocketed, proving itself as a hedge against the very system that seeks to undermine you.

Then there are precious metals—gold and silver—known for centuries as safe havens in times of economic uncertainty. They’ve been used as money for thousands of years and retain intrinsic value. When the fiat system crumbles or inflation soars, gold and silver shine as the go-to store of wealth.

In a world where inflation is a silent tax imposed by governments expanding the monetary supply, it’s time to wake up and take control. Don’t let your hard work evaporate in the face of rising prices. Invest in Bitcoin and precious metals, and build a fortress against the silent tax that’s eating away at your wealth. It’s your money—protect it.

Bitcoin as a Hedge Against Inflation – A Resilient Investment

Learn why Bitcoin is a crucial hedge against inflation in A Beginner’s Guide to Bitcoin.” Discover how Bitcoin’s fixed supply and decentralized nature make it a resilient investment, protecting your wealth from economic uncertainties and fiat currency devaluation. Join Resilient not Reliant to explore the benefits of Bitcoin and build a financially secure future.

At Resilient not Reliant (RnR), we understand the importance of safeguarding our financial future against economic uncertainties. Bitcoin has emerged as a powerful tool in our strategy to build resilient finances. Its fixed supply and decentralized nature make it an attractive hedge against inflation, a phenomenon where fiat currencies lose value over time due to central bank money printing.

Why Resilient not Reliant Invests in Bitcoin

We invest in Bitcoin because it aligns perfectly with our philosophy of reducing dependency on centralized systems. During the COVID-19 pandemic, governments worldwide printed trillions of dollars to mitigate economic damage, leading to the devaluation of fiat currencies. As the value of fiat money dropped, limited-supply assets like Bitcoin saw significant value appreciation. This period attracted traditional investors to Bitcoin, recognizing its potential as a hedge against inflation and driving its price up by over 250% in a matter of months.

Bitcoin’s limited supply of 21 million coins creates a scarcity that inherently protects against inflation. Unlike fiat currencies, which can be printed in unlimited amounts, Bitcoin’s supply is capped, ensuring its value is not eroded by overproduction. This makes Bitcoin a crucial component of our financial strategy to achieve long-term security and independence.

Understanding Inflation

Inflation can be understood in two distinct ways: the increase in the cost of goods and services, often measured by the Consumer Price Index (CPI), and monetary inflation, which refers to the increase in the overall monetary supply. CPI inflation is characterized by the gradual rise in prices of everyday items, meaning it takes more money to purchase the same goods over time, thereby reducing purchasing power.

Monetary inflation, on the other hand, occurs when a central bank increases the supply of money. This practice devalues the currency itself and further erodes purchasing power. Essentially, monetary inflation is a silent tax imposed by central banks and governments. As they print more money, the value of each your dollars decreases, effectively stealing your purchasing power without directly taking money from your wallet.

Throughout history, 100% of governments have devalued their currencies until they eventually collapse. This pattern underscores the importance of protecting our wealth from this insidious process.

Central banks monitor and manage both types of inflation to maintain economic stability. While moderate CPI inflation is often touted as beneficial because it encourages consumer spending and supports economic growth, this narrative can be misleading. In reality, high or rapidly increasing CPI inflation erodes the value of savings and delays retirement plans.

Monetary inflation, driven by the excessive printing of money, significantly devalues the currency. Protecting our wealth from both CPI and monetary inflation is crucial, and Bitcoin offers a compelling solution. Bitcoin’s fixed supply and decentralized nature provide a hedge against currency devaluation, helping to safeguard financial stability.

Bitcoin and Inflation

Bitcoin is designed to resist inflation, experiencing predictable and low inflation rates due to its mining process, which halves the creation of new coins every four years. This controlled supply increase mirrors the stable inflation rate of gold, making Bitcoin a reliable store of value.

Although Bitcoin is not entirely “inflation-proof,” its fixed supply and decentralized nature make it more “inflation-resistant” compared to traditional fiat currencies. This resistance, combined with its long-term growth potential, positions Bitcoin as a superior hedge against inflation.

Benefits of Bitcoin’s Fixed Supply

One of the key factors making Bitcoin resistant to inflation is its scarcity. With only 21 million Bitcoins ever to exist, this limited supply ensures that its value remains steady over time. Satoshi Nakamoto, Bitcoin’s pseudonymous creator/discoverer, designed it to appreciate in value as a direct response to the 2008 financial crisis, aiming to provide a decentralized and secure alternative to traditional currencies.

As Bitcoin’s maximum supply is reached sometime in 2140, no new coins will be created, ensuring its scarcity and value retention. This fixed supply differentiates Bitcoin from other assets and makes it a cornerstone of our investment strategy at Resilient not Reliant.

The Role of Bitcoin in a Recession

Bitcoin’s origin in the aftermath of the 2008 financial crisis highlights its potential as a recession-resistant asset. Unlike fiat currencies tied to national economies, Bitcoin’s value is derived from global demand, making it inherently diversified and less susceptible to localized economic downturns.

In a recession, Bitcoin’s decentralized and scarce nature provides stability and value, independent of any single economy’s performance. This makes Bitcoin a critical component of our strategy to build resilient finances and protect against economic instability.

At RnR, we believe in the power of Bitcoin to safeguard our financial future. Its fixed supply, decentralized nature, and long-term growth potential make it an ideal hedge against inflation and economic uncertainty. By investing in Bitcoin, we are taking proactive steps to protect our wealth, achieve financial independence, and build a resilient community prepared for whatever challenges lie ahead.

Is Bitcoin Superior to Gold?

Discover why Bitcoin is a better hedge against monetary inflation than gold. Learn how Bitcoin’s fixed supply, decentralization, and digital nature provide superior protection against currency devaluation and government financial repression. Understand the benefits of Bitcoin’s portability and security, making it an ideal asset for maintaining financial independence and stability during crises. Explore the advantages of Bitcoin over gold with Resilient not Reliant.

As we seek ways to protect our wealth from the ravages of monetary inflation and government financial repression, Bitcoin stands out as a superior choice compared to gold. While gold has historically been seen as a safe haven asset, Bitcoin offers unique advantages that make it a more effective hedge against inflation, a better tool for maintaining financial independence, and a more practical option for preserving wealth during crises.

Superior Hedge Against Monetary Inflation

Gold has long been used as a hedge against inflation due to its intrinsic value and limited supply. However, Bitcoin’s fixed supply of 21 million coins provides an even more reliable safeguard against monetary inflation. Unlike gold, which can still be mined and discovered in new deposits, Bitcoin’s supply is capped, ensuring its scarcity and protecting its value from dilution.

Monetary inflation occurs when central banks print excessive amounts of money, devaluing the currency and eroding purchasing power. Bitcoin, as a decentralized digital currency, is immune to such manipulation. Its value is not subject to the whims of government policies or central bank decisions, making it a more stable and predictable hedge against inflation.

Independence from Government Financial Repression

Gold is often stored in centralized locations such as banks or vaults, making it susceptible to government control and seizure. In times of financial repression, governments have historically confiscated gold or imposed restrictions on its ownership. Bitcoin, however, operates on a decentralized network that is not controlled by any single entity. This decentralization ensures that your Bitcoin holdings remain outside the reach of government interference.

Moreover, Bitcoin transactions are secured through cryptographic techniques, making them highly secure and resistant to fraud. Unlike gold, which requires physical storage and protection, Bitcoin can be stored digitally in a wallet and accessed with a private key. This digital nature allows for greater privacy and autonomy, ensuring that your wealth remains truly yours.

Practicality During Crises

In the event of a crisis, such as political instability or economic collapse, being able to quickly and safely move your wealth becomes paramount. Gold, due to its physical nature, presents significant challenges in terms of transportability and security. It is heavy, difficult to conceal, and requires physical storage, which can be easily targeted and confiscated.

Bitcoin, on the other hand, offers unparalleled portability and security. It can be stored digitally and accessed from anywhere in the world with an internet connection. Furthermore, your Bitcoin holdings can be secured with a memorized seed phrase, making it possible to transport your wealth without carrying any physical assets. This ease of transport and secure storage make Bitcoin an ideal asset for individuals who may need to leave their country quickly in times of crisis.

Decentralization and Security

Gold tends to concentrate in centralized storage facilities due to its physical characteristics. This centralization poses risks of theft, government seizure, and logistical challenges in accessing and moving the asset. Bitcoin, with its decentralized network, eliminates these risks. It is stored on a distributed ledger known as the blockchain, which is maintained by a global network of nodes. This decentralization ensures that no single point of failure can compromise the security or accessibility of your Bitcoin holdings.

Additionally, Bitcoin’s blockchain technology provides transparency and immutability, allowing for verifiable and secure transactions. Unlike gold, which relies on physical verification and trusted intermediaries, Bitcoin transactions are verified by the network, reducing the risk of fraud and enhancing trust in the system.

In conclusion, Bitcoin offers several advantages over gold as a hedge against monetary inflation and a means of maintaining financial independence. Its fixed supply, decentralization, and digital nature make it a more effective safeguard against currency devaluation and government financial repression. Moreover, Bitcoin’s portability and security make it a practical choice for preserving wealth during crises. By embracing Bitcoin, we can protect our financial future and ensure that our wealth remains secure and accessible, regardless of the challenges we may face.

A Beginner’s Guide to Bitcoin

Learn why Bitcoin is a crucial hedge against inflation in “A Beginner’s Guide to Bitcoin.” Discover how Bitcoin’s fixed supply and decentralized nature make it a resilient investment, protecting your wealth from economic uncertainties and fiat currency devaluation. Join Resilient not Reliant to explore the benefits of Bitcoin and build a financially secure future.

Bitcoin, often referred to as digital gold or digital property, has gained significant popularity and acceptance since its creation in 2009. As a decentralized currency, it operates outside traditional banking systems, offering a new way to store and transfer value. This article will help you understand the basics of Bitcoin, its benefits, and how to get started with investing in it.

What is Bitcoin?

Bitcoin is a digital currency created by an unknown person or group of people using the pseudonym Satoshi Nakamoto. This is key because it has no owner, no CEO, no address and no manager that can change the underlying properties of Bitcoin. Unlike traditional currencies, it is not issued or controlled by any government or central bank either. Instead, Bitcoin transactions are verified by network nodes through cryptography and recorded on a public ledger called the blockchain.

The blockchain is a decentralized system where transactions are grouped into blocks and linked together in a chain. This ensures transparency, security, and immutability, making it nearly impossible to alter or forge transactions. Key when governements do this on a daily basis.

Why Invest in Bitcoin?

There are several reasons why Bitcoin is considered a valuable investment:

1. Decentralization: Bitcoin is not controlled by any central authority, reducing the risk of government interference or manipulation.

2. Limited Supply: There will only ever be 21 million Bitcoins in existence, creating scarcity and potentially driving up its value over time.

3. Security: Bitcoin transactions are secured through cryptographic techniques, making them highly secure and resistant to fraud.

4. Transparency: All Bitcoin transactions are recorded on the blockchain, allowing anyone to verify and audit transactions.

5. Global Acceptance: Bitcoin can be used globally without the need for currency exchange, making it a universal medium of exchange.

Why Resilient not Reliant Invests in Bitcoin

At RnR, we view Bitcoin as a cornerstone of financial resilience and independence. In a world where fiat currencies, which are any currency backed by nothing more than the trust of it’s government, are subject to inflation and devaluation, Bitcoin is a better alternative. At a minimum, Bitcoin is a reliable store of value - at best, it is the greatest performing asset of all time. Which isn’t a bad reason to invest either. Its decentralized nature also aligns with our philosophy of reducing dependency on centralized systems and authorities.

By investing in Bitcoin, we are not only protecting our wealth from the erosion of purchasing power caused by excessive money printing but also embracing a form of currency that empowers individuals. Bitcoin’s scarcity and deflationary properties make it a powerful hedge against economic instability, providing a safeguard for our financial future.

Furthermore, Bitcoin’s growing acceptance and integration into the global financial system enhance its utility, making it a versatile asset in our investment strategy. Through Bitcoin, we aim to achieve financial security and offset the financial fuckery taking place that devalues currency via money printing.

Oh yea - it’s is also up 20,000,000% since 2011… Yes, twenty million. Enough said ;)

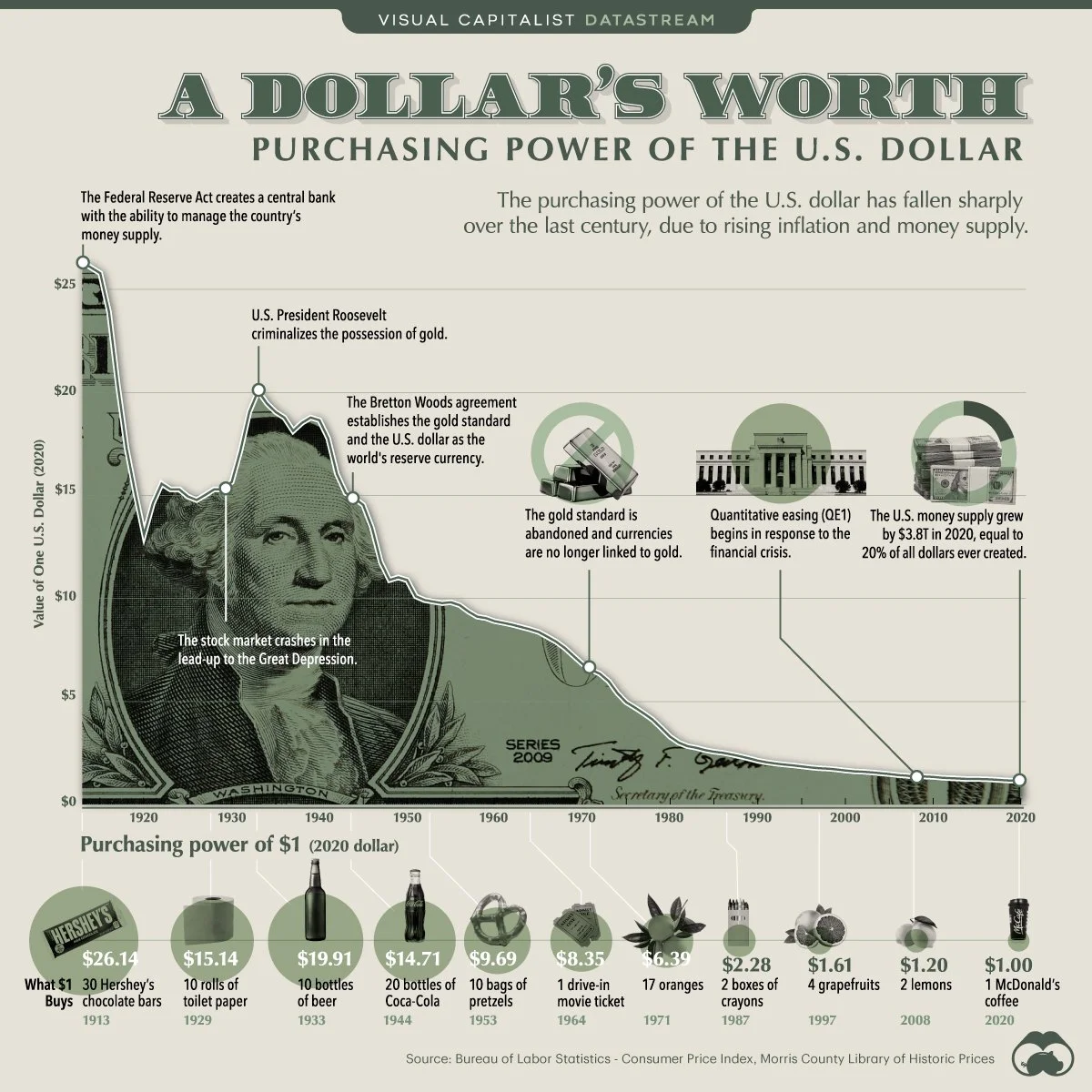

Here is a visual on the decline of purchasing power of the US Dollar for comparison.

Getting Started with Bitcoin

Here’s a step-by-step guide to help you get started with investing in Bitcoin:

1. Educate Yourself: Before investing in Bitcoin, it’s essential to understand how it works, its potential risks, and benefits. Read articles, watch videos, and follow reputable sources to stay informed.

2. Choose a Wallet: A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. There are several types of wallets:

• Hardware Wallets: Physical devices that store your Bitcoin offline, providing the highest level of security.

• Software Wallets: Applications that you can install on your computer or mobile device.

• Web Wallets: Online services that store your Bitcoin for you. We don’t use these for anything more than buying Bitcoin. Always store your crypto on a hardware wallet like Ledger or Trezor.

3. Select an Exchange: To buy Bitcoin, you need to use a cryptocurrency exchange. These can be centralized (CEX) or decentralized (DEX). Some popular CEX’s include Coinbase, Binance, and Kraken. Popular DEX’s include Pancake swap, Sushiswap, and Matcha.

4. Buy Bitcoin: Once your account is set up, you can purchase Bitcoin. You can buy a fraction of a Bitcoin, making it accessible even if you don’t have a lot of money to invest.

5. Secure Your Investment: After purchasing Bitcoin, transfer it to your wallet for safekeeping. Avoid leaving your Bitcoin on the exchange, as exchanges can be vulnerable to hacks.

6. Stay Informed: The cryptocurrency market is highly volatile, so it’s crucial to stay updated on the latest news and trends. Follow reputable sources and consider joining online communities to learn from other investors.

Potential Risks and Considerations

While Bitcoin offers many benefits, it’s essential to be aware of the potential risks and challenges:

1. Volatility: Bitcoin’s price can be highly volatile, with significant price swings occurring over short periods. Be prepared for fluctuations in value and invest only what you can afford to lose.

2. Regulatory Risks: Governments around the world are still figuring out how to regulate Bitcoin and other cryptocurrencies. Changes in regulations could impact its value and usability.

3. Security Risks: While Bitcoin transactions are secure, the wallets and exchanges that store Bitcoin can be vulnerable to hacking. Always use reputable services and take steps to secure your investments.

4. Market Sentiment: Bitcoin’s value can be influenced by market sentiment, news, and events. Stay informed and be cautious of hype and speculation.

Bitcoin represents a revolutionary shift in how we think about money and finance. Its decentralized nature, limited supply, and growing acceptance make it an attractive investment for those looking to diversify their portfolios and hedge against traditional financial systems.

By educating yourself, choosing the right tools, and staying informed, you can successfully navigate the world of Bitcoin and potentially reap the benefits of this innovative digital currency. At RnR, we believe in empowering individuals with the knowledge and resources needed to build resilient finances. Start your journey with Bitcoin today and take control of your financial future.

Building Resilient Finances: Your Path to Independence

Discover how to build resilient finances with Resilient not Reliant. Learn the principles of financial independence, including income generation, investing in hard assets like Bitcoin and real estate, and optimizing your taxes. Achieve true financial security and wealth creation by embracing these strategies and protecting yourself against inflation and economic uncertainties. Join our community dedicated to financial empowerment and independence.

At Resilient not Reliant (RnR), we believe that true financial resilience goes beyond simply managing money. It’s about creating wealth, securing assets, and developing systems that protect against economic uncertainties. This article explores the principles of building resilient finances and the core assets we believe in for long-term security and independence.

The Financial Repression Trap

Financial repression is how governments and central banks manipulate the economic environment to their advantage, often at the expense of individual wealth. This includes mechanisms such as:

Taxes: Ongoing obligations that reduce disposable income and savings.

Currency Debasement: Devaluation of fiat currency through excessive printing, leading to inflation.

Inflation: The gradual erosion of purchasing power, making goods and services more expensive over time.

Abolishment of Private Property: Through various regulations and taxes, the government can make it difficult to maintain personal wealth and assets.

At RnR, we aim to counteract these tactics by adopting a proactive approach to financial management. Our goal is to empower individuals to retain more of their money, grow their wealth, and achieve financial independence.

Principles of Resilient Finances

Building resilient finances involves several key principles:

Income Generation: Create diverse streams of income to reduce dependency on any single source. This could include traditional employment, freelance work, side businesses, and investments.

Hard Assets: Invest in tangible assets that hold or increase in value over time. Unlike fiat currency, which can be devalued, hard assets provide a hedge against inflation and economic instability.

Tax Optimization: Legally reduce tax obligations through smart financial planning and utilizing available deductions and credits. Keeping more of what you earn is essential for building wealth.

Financial Education: Continuously educate yourself about financial management, investment opportunities, and economic trends. Knowledge is power when it comes to making informed financial decisions.

Core Assets for Long-Term Security

To safeguard against dollar debasement and economic uncertainties, we focus on several core assets that historically hold or increase their value:

Bitcoin and Cryptocurrencies: Bitcoin, often referred to as digital gold, is a decentralized currency that operates outside traditional banking systems. Its limited supply and increasing acceptance make it a strong hedge against inflation. Other cryptocurrencies also offer potential for growth and diversification, though they come with higher volatility and risk.

Real Estate: Property ownership is a time-tested strategy for wealth preservation and growth. Real estate provides passive income through rentals and potential appreciation in value over time. It’s a tangible asset that can withstand economic fluctuations better than fiat currency.

Businesses and Income-Producing Systems: Building or investing in businesses creates ongoing income streams and opportunities for growth. This can include anything from small local businesses to scalable online enterprises. The key is to create systems that generate income independently of your direct efforts, allowing for financial freedom and stability.

Why Resilient Finances Matter

Resilient finances are crucial for achieving true independence and security. Here are some reasons why building resilient finances is essential:

Protection Against Inflation: As fiat currencies lose value, hard assets like Bitcoin, real estate, and income-producing businesses provide a buffer against inflation. They preserve purchasing power and can even appreciate in value.

Financial Independence: By generating diverse income streams and investing in resilient assets, you reduce dependency on traditional employment and economic systems. This independence allows for greater freedom and security in your financial life.

Wealth Creation: Resilient finances are about growing wealth, not just preserving it. By investing in appreciating assets and optimizing your financial strategies, you can build significant wealth over time.

Empowerment: Financial resilience empowers you to make decisions based on your goals and values, rather than economic pressures. It gives you the confidence and capability to navigate financial challenges and opportunities effectively.

Building resilient finances is about more than just managing money—it’s about creating a foundation of security and independence that can withstand economic uncertainties. By focusing on income generation, investing in hard assets like Bitcoin and real estate, and continually educating ourselves, we can achieve true financial resilience.

Join us at RnR as we strive to empower individuals to take control of their financial futures and build a community dedicated to strength, independence, and preparedness.