Bitcoin as a Hedge Against Inflation – A Resilient Investment

At Resilient not Reliant (RnR), we understand the importance of safeguarding our financial future against economic uncertainties. Bitcoin has emerged as a powerful tool in our strategy to build resilient finances. Its fixed supply and decentralized nature make it an attractive hedge against inflation, a phenomenon where fiat currencies lose value over time due to central bank money printing.

Why Resilient not Reliant Invests in Bitcoin

We invest in Bitcoin because it aligns perfectly with our philosophy of reducing dependency on centralized systems. During the COVID-19 pandemic, governments worldwide printed trillions of dollars to mitigate economic damage, leading to the devaluation of fiat currencies. As the value of fiat money dropped, limited-supply assets like Bitcoin saw significant value appreciation. This period attracted traditional investors to Bitcoin, recognizing its potential as a hedge against inflation and driving its price up by over 250% in a matter of months.

Bitcoin’s limited supply of 21 million coins creates a scarcity that inherently protects against inflation. Unlike fiat currencies, which can be printed in unlimited amounts, Bitcoin’s supply is capped, ensuring its value is not eroded by overproduction. This makes Bitcoin a crucial component of our financial strategy to achieve long-term security and independence.

Understanding Inflation

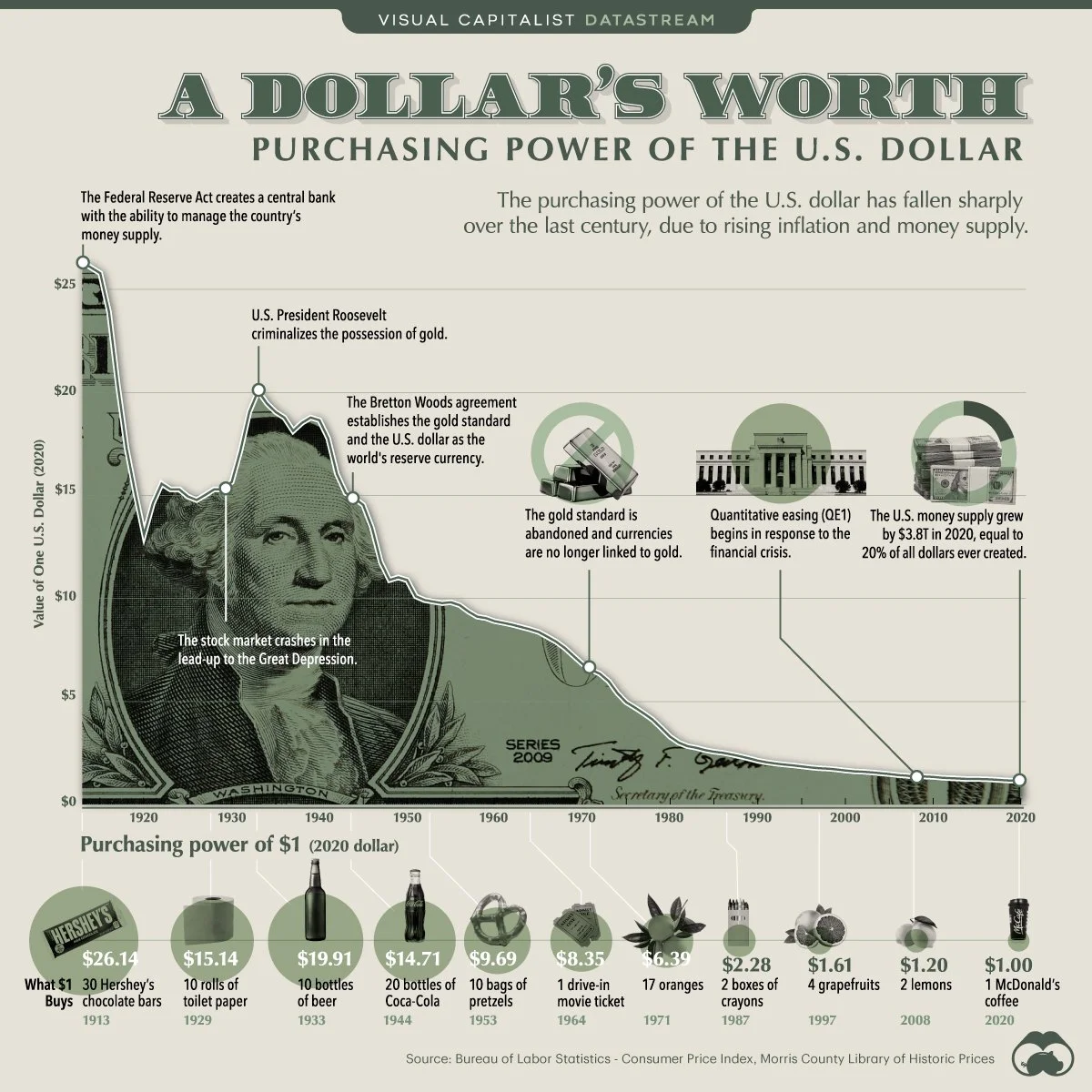

Inflation can be understood in two distinct ways: the increase in the cost of goods and services, often measured by the Consumer Price Index (CPI), and monetary inflation, which refers to the increase in the overall monetary supply. CPI inflation is characterized by the gradual rise in prices of everyday items, meaning it takes more money to purchase the same goods over time, thereby reducing purchasing power.

Monetary inflation, on the other hand, occurs when a central bank increases the supply of money. This practice devalues the currency itself and further erodes purchasing power. Essentially, monetary inflation is a silent tax imposed by central banks and governments. As they print more money, the value of each your dollars decreases, effectively stealing your purchasing power without directly taking money from your wallet.

Throughout history, 100% of governments have devalued their currencies until they eventually collapse. This pattern underscores the importance of protecting our wealth from this insidious process.

Central banks monitor and manage both types of inflation to maintain economic stability. While moderate CPI inflation is often touted as beneficial because it encourages consumer spending and supports economic growth, this narrative can be misleading. In reality, high or rapidly increasing CPI inflation erodes the value of savings and delays retirement plans.

Monetary inflation, driven by the excessive printing of money, significantly devalues the currency. Protecting our wealth from both CPI and monetary inflation is crucial, and Bitcoin offers a compelling solution. Bitcoin’s fixed supply and decentralized nature provide a hedge against currency devaluation, helping to safeguard financial stability.

Bitcoin and Inflation

Bitcoin is designed to resist inflation, experiencing predictable and low inflation rates due to its mining process, which halves the creation of new coins every four years. This controlled supply increase mirrors the stable inflation rate of gold, making Bitcoin a reliable store of value.

Although Bitcoin is not entirely “inflation-proof,” its fixed supply and decentralized nature make it more “inflation-resistant” compared to traditional fiat currencies. This resistance, combined with its long-term growth potential, positions Bitcoin as a superior hedge against inflation.

Benefits of Bitcoin’s Fixed Supply

One of the key factors making Bitcoin resistant to inflation is its scarcity. With only 21 million Bitcoins ever to exist, this limited supply ensures that its value remains steady over time. Satoshi Nakamoto, Bitcoin’s pseudonymous creator/discoverer, designed it to appreciate in value as a direct response to the 2008 financial crisis, aiming to provide a decentralized and secure alternative to traditional currencies.

As Bitcoin’s maximum supply is reached sometime in 2140, no new coins will be created, ensuring its scarcity and value retention. This fixed supply differentiates Bitcoin from other assets and makes it a cornerstone of our investment strategy at Resilient not Reliant.

The Role of Bitcoin in a Recession

Bitcoin’s origin in the aftermath of the 2008 financial crisis highlights its potential as a recession-resistant asset. Unlike fiat currencies tied to national economies, Bitcoin’s value is derived from global demand, making it inherently diversified and less susceptible to localized economic downturns.

In a recession, Bitcoin’s decentralized and scarce nature provides stability and value, independent of any single economy’s performance. This makes Bitcoin a critical component of our strategy to build resilient finances and protect against economic instability.

At RnR, we believe in the power of Bitcoin to safeguard our financial future. Its fixed supply, decentralized nature, and long-term growth potential make it an ideal hedge against inflation and economic uncertainty. By investing in Bitcoin, we are taking proactive steps to protect our wealth, achieve financial independence, and build a resilient community prepared for whatever challenges lie ahead.